Changing Current Carbon Policies

All of the information and data presented on this website has one goal: convince the reader to support the implementation of a carbon tax in order to help save the environment and human life. The current cap and trade system that has been implemented in some states in the U.S. is not currently working. There is two specific reasons as to why it is not working. First, it is not done at the federal level. Only 11 states in the U.S. actually use a cap and trade system. That is not enough states to actually significantly reduce CO2 emissions. The second and most important reason as to why it is not working is because the level of emissions that the cap is set at is normally too high. The level they cap emissions at is still at unsustainable rates. This can be seen not only here in the U.S. but also in places like Australia, New Zealand, and the European Union. The policy has been somewhat successful in stopping the increase of emissions and even lowering them some but not at rates that are fast enough to avoid environmental disaster. New policies must be implement at the federal level in order to curb climate change.

Why a Carbon Tax?

A carbon tax is the correct form of policy to choose because it would help reduce CO2 emissions to sustainable levels. The best way to guide corporations into making responsible choices is by effecting the profits they are making. A carbon tax would reduce the profit margins big producers of carbon emissions make. It would force them to reduce the amount of carbon emissions they produce which would therefor reduce the negative impacts these producers are having on the environment.

Impact a Carbon Tax has on an Economy

“A price on carbon unlocks the potential of the private sector, like business and investors to contribute more and faster to addressing climate change by ensuring an economic incentive” -Feike Sijbesma, CEO of Royal DSM and World Bank Climate Leader. What Feike is eluding to is that a carbon tax provides companies an economic incentive to reduce their emissions. It forces the hand of carbon emission producers without banning CO2 production. It allows an economy to come to a new equilibrium of production on their own accord. This helps dampen the negative impacts that reducing carbon emissions has on an economy. Since carbon emissions are intrinsically tied into energy production, reduction in the amount of emissions can cause a supply shock in the economy. Ultimately stating that the supply of energy would potentially be reduced by a large amount. Energy is used in every industry in a country and the lack of energy could result in an economic recession. What normally happens though is that prices of energy end up increasing so energy corporation can stay in business which also can cause an economic recession. A slow implemented carbon tax allows carbon emission producers to slowly transition to less carbon emitting methods without sparking an economic recession.

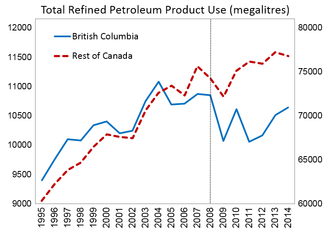

Currently there are many countries and areas around the world that have implemented carbon taxes and are still thriving economically. British Columbia is a perfect example of how to implement a carbon tax without causing economic damage. They decided to implement a carbon tax on corporations, but they started very slow. They kept the tax rates low when they first initiated it and set forth a plan to reach a higher-level tax rate by 2021 by slowly increasing the tax rate annually. This allowed corporations to plan for the future so year by year they could start to reduce their carbon emissions. British Columbia also decided to then use the revenue created by the carbon tax to provide carbon tax relief to corporation making the switch to less carbon emissions. This allowed corporations to not take a hit in their profits but still reduce their amount of carbon emissions. Not only did British Columbia’s economy not collapse, but it grew more than the neighboring providences and did it while reducing greenhouse gas emissions by 15 percent.

My Proposed Carbon Policy for the U.S.

The carbon policy I propose for the U.S. looks very similar to the policy in British Columbia. It would be a specialized corporation tax. This means that it would not tax the everyday consumer. There is two reasons for this. The first one being that many CO2 emitting actions or products are very inelastic. This means that the price of it can have a large variance but the consumption does not change much. For example, lets look at gasoline. If a gallon of gas rose by a 1$ the consumption of it would not decrease by much. People still need to be able to drive places, mainly work, and goods and services still need to be delivered. Also, when gas goes up normally the price of other goods go up. This leads me to my second point. A tax implemented on the everyday consumer would mainly impact lower income individuals. A slight increase in prices of gas or goods would have minimal impacts on people who are well off. It would have a large impact on the people who live pay check to pay check. The point of implementing a carbon tax is not to harm poorer parts of the population. In fact, it is to help them. Poorer people are systematically more prone to worse environmental conditions. So for those two reasons, the carbon tax would only be on the corporations.

The carbon tax would also be structured in a way that it is slowly increased over time. Instead of coming down with a crazy high tax that would negatively impact the economy, it would be better to start off slow. It takes time for big corporations to change how they do things. By slowly increasing the tax it gives the corporations time to start to implement changes. There would also be carbon tax relief for corporations who start to reduce their emissions. This would come in the form of subsidies. This would give corporations an incentive to not only reduce their emissions but also switch to less CO2 emitting methods. It is a way to systematically guide corporations into becoming environmentally friendly without negatively impacting the economy.

Implementing a policy like this will greatly reduce CO2 emissions in the U.S.. With how it is structured it will take some time though. As long as the carbon pricing is correct, eventually the U.S. can achieve levels that are sustainable and can do it without negatively impacting the economy.

How Do We Actually Get This Policy Implemented?

This is the most important question that needs to be answered. It does not suffice to merely explain why and how a carbon tax will produce a positive change if it never actually gets implemented. The answer to this question first starts with you, the reader. This knowledge needs to be spread and talked about way more regularly than it is. There is a ton of fallacious information that is spread and believed today. People still deny climate change exists. This idea needs to be smashed. People need to be presented with the facts and confronted on their false ideologies. Continuing to deny the existence of it only perpetuates the problem. There is also this common notion that any form of tax is bad for the consumer and the economy. This belief is incorrect. If a tax is implemented properly, it can actually benefit society as a whole. That would be the result from this tax yet so many people and politicians believe it would be disastrous for the economy. Politicians use fear to convince people that something is bad and to be afraid of it. This leads me to my next point. Not only must there be an open dialogue on this topic based on facts but people must also go out and vote. We need to be voting for politicians that agree with these ideologies and would vote to have a tax like this implemented. If people do not vote the right people in, then nothing will change.

Overall my goal is for a brighter safer world for all of us to live in. It is my belief and the belief of most of the worlds climate change scientists that to continue down the path we are on will lead to devastating outcomes. I urge everyone to do as much research as they can on the subject and to go out into the world and try to enact change. If anybody has any questions about the plan outlined here feel free to contact me through the contact link in the top right. Also feel free to provide any criticism or feedback you have for me. Thanks!